I didn’t really have many expectations going into the movie (good or bad), but I actually really enjoyed it. I really liked the characters and the banter between them.

... View MoreIt really made me laugh, but for some moments I was tearing up because I could relate so much.

... View MoreStory: It's very simple but honestly that is fine.

... View MoreAn old-fashioned movie made with new-fashioned finesse.

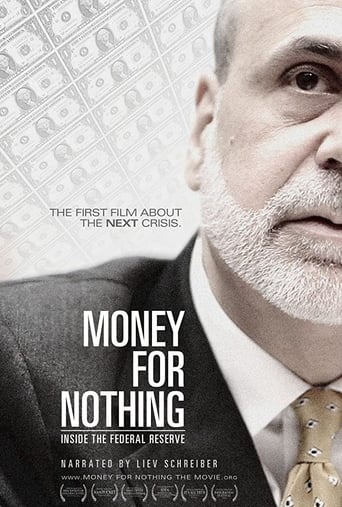

... View MoreThis was very disappointing. Every talking head and expert in this "documentary" have a vested interest in the continuation of the FED. This does not equate to a well rounded documentary, this is what we call propaganda kids. It's like Monsanto making a "cutting edge no holds bar" documentary about...well...Monsanto. The blatant fraud of the Fed can be seen in it's name: It's no more federal than Federal Express and it has no reserves, it just prints all the money it wants without any accountability or backing. A federal Reserve note (dollar bill) has no more significance than if I printed a dollar from my computer. This worthless money is then loaned to our government at a 6% interest rate and we pay the bill.! There is no ballot measure that we voted on, there is no say what-so-ever from the people, the government can borrow all they want from the FED and have no accountability to the people. How in the hell does this make it good for the people?! They create money out of thin air and charge interest from it! That's fraud! The president of the US does in fact choose who runs the Fed, but guess what the film "forgot" to mention? The Fed gives the president a list of people to choose from! Ha! Bet you didn't know that? The Federal Reserve is far more harmful than this documentary makes it out to be. The FED can single handedly crush our entire system if they wanted to, think about it. Why would this EVER be a good thing. It's no different then the medieval kings back in Europe. "If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered...I believe that banking institutions are more dangerous to our liberties than standing armies... The issuing power should be taken from the banks and restored to the people, to whom it properly belongs." -Thomas Jefferson-The Fed also prints money out of thin air then lends it to dozens of counties around the world through organizations such as the International Monetary Fund and the World Bank. This creates a massive inflation cycle and an outrageous bill for the American tax payers children to pay back when other countries default. Inflation is a tax, make no mistake about it. If your dollar is worth 20 cents less than it was it's no different than an increase of income tax by 20%. The only difference is, borrowing from the FED is not out in the open like an income tax, it's in the background and mostly all Americans never catch onto this. Since the creation of the Federal Reserve System, 90%!! of our dollar has been eaten away by inflation! "Permit me to issue and control the money of a nation, and I care not who makes its laws!"Oh and another thing, the 12 member banks of the FED creates no safeguards against centralization. They are simply franchises of the same owner. All rules and regulations are passed down from the top (the Federal Reserve bank of New York). They are only there as an illusion of a non centralized bank, think about it; can the Federal Reserve bank in San Francisco issue a different interest rate than the one in NY? Of course not, they're all attached and they all act in unison. Everyone should look into The Bank of North Dakota, the only state-owned bank in the nation. They have no debt and have been unbelievably successful. This is the direction we need to head, we should obey and respect the 10th amendment and decentralize almost everything, let states take back what rights they use to have. This is the point of the United STATES was it not? Independent states that can independently succeed on their own. Do we really want this country to turn into The United Federation of America, a country without independent states who's sole rule maker comes from Washington DC? I don't.

... View Morethe best Documentary on the topic are the money master and Money As Debt,i assume the producer At least have seen them but they haven't.for the part where money was created,Borrowing is the major way ,when someone Borrow from bank where does the money come from,does it came from your Account? i don't think so . if this was the case you will notice. does it come from bank's money? i don't think so ,they need it for the Bonus. in fact it's money from nowhere created by the bank, it's a Obligation that bank has to pay the Borrower in exchange for the the Promise that the Borrower will pay back more, yes it's that twisted, for instance the Borrower spend the money and the money usually end up in some Account in the bank, bank's Assets(everyone's saving plus the Borrower's Promise) and its liability (Obligation to pay Depositor and the Borrower) both increase ,and as long as the bank's Assets is greater than its liability ,the came can continue forever.as for the fed which is a Private bank with its own share holders just as the Central Bank of the United Kingdom, it is responsible for the Creation of U.S. dollar. the Borrower is US government. as for Greenspan who has been Praised a lot by the movie (at least by the people they Interview) is not the Reason for the U.S. economy to be Prosperity in 1990. the true Reason is that sucker like china gone dollar-Fever , they pumping low-cost merchandise into US in exchange for green paper which keep the Cost of Living low while Destroy the manufacturing industry of US thus free the whole Country to work in Financial sector which Attract suckers all over the world to Invest in its Stock market. lots of Big shot Appear in the movie, but it didn't help, because they only help Themselvesin the end they try to Summary that the wallstreet did what they did because fed made the money easy and the fed did what they did because they are simply unware of the Consequence of their Behavior, which is so not true, anyone with a basic Knowledge of Economy knows what would happen if the Leverage was too higha better choose of Documentary on Financial crisis would be inside job and meltdown by cbc

... View MoreMoney for nothing is an excellent, compelling, revealing and accurate look at how the FED distorts and manipulates the world economy. There are no conspiracy theories here, just the cold, hard facts. It is a sobering, unflinching look at what brought the world to the brink of collapse in 2007 and the aftermath. The movie doesn't interview former FED chairmen Greenspan or Bernanke (and really what but confusion could come from that anyway?) but lets them speak (lie) for themselves through past interviews and speeches. Interestingly included is the Fed's current chairman Janet Yellen (perhaps she had no idea she would be future chairman at the time of filming), interesting because at the end of the movie FED is portrayed has ultimately clueless and inept (and I believe it is behaving as such). Also included is a vast cast of observers and commentators; including former Fed chairman Paul Volcker, current and former regional Fed presidents, vice presidents and governors, as well as columnists, academicians, book authors and major investors whom study the Fed. Curiously absent is anyone from the current TBTF banks or any banks or businessmen at all for that matter. What the film sadly leaves out is any mention of the role of cheap energy, as if our economy exists on the back of the banking system alone! WWI is implicated in the abandonment of the gold standard when the reality was: who needs gold when you have abundant cheap energy? Just print the money you need to finance whatever you want. Future growth fueled by cheap energy will pay all the bills. The United States realized this much too late during the Great Depression, sticking to the gold standard and unable to jump-start the economy by borrowing against future growth enabled by cheap, abundant crude oil. Thus the deep flaw of this film is that the availability (or lack thereof) of cheap energy is never implicated in any of our economic problems and fortunes, as if the fed alone creates and controls economic activity. It often misattributes economic events to the actions of the Fed which are in fact more closely tied to the price of crude oil. Despite the movie's blind spot with regard to the role energy plays in the economy it otherwise leaves no stone unturned. We learn about the terrible precedent set by the bailout of LTCM and the psychology of the "Greenspan Put". Greenspan birthed the idea of a free lunch, heads you win, tails you win (the fed bails you (or whatever market you are playing in) out), all reward and very little risk. We learn how the Fed and Fed alone created the biggest asset bubble in American history. We learn what a precarious position our economy is now in despite appearances, appearances due to the distortions of the markets by the Fed. The Fed can't take away the "punch bowl" (QE and zero percent interest rates) EVER and it knows it. The fact that we print the world's reserve currency is the only thing keeping this country from disaster. The film's conclusion totally misses the fact that we are suffering from the gradual depletion of cheap energy. Some great quotes: After closing the "gold window" Nixon tells America: "What does this mean for you? You're dollar will be worth just as much tomorrow as it today" probably one of the greatest lies ever told. On Greenspan: "This alleged libertarian was presiding over the socialization of risk in our economy " The now infamous Bernanke quote (in perfect context): "The problem in the subprime market seems likely to be contained" (March 2007!) Greenspan: "I've always believed we underestimate the impact of stock prices on economic activity, (open bracket) (close bracket) if (open bracket) the stock market (close bracket) continues higher this will do more to stimulate the economy than anything (open bracket) else could (close bracket)." Greenspan (2011): "The United States can pay any debt it has because we can always print money to do that, so there is zero probability of default." The games the Fed is playing with our economy can only last for so long.

... View MoreThe movie ends by suggesting that the latest bubble was essentially caused by an 'Asset Inflation' due to the fact that apparently the US Federal Reserve no longer takes into account housing or essentially fuel prices!? What, that is obviously false... Check the US Bureau of Labor Statistics and you will see that both are definitely in there.I would agree that they have changed the way that some items have been covered, namely the housing prices which are now calculated as basically the rental equivalent of each home owners home instead of the housing price. Though, that is common among the OECD nations just like Canada and a few others. Check the US Consumer Price Index website and you will see. Also check this link, which explains some of the misconceptions out in the general public: http://www.bls.gov/cpi/cpiqa.htm As for the rest of the movie, well it hammers away at your intelligence with misinformation and jarring commentary. The movie was partly informative for creating an interesting story of Volcker, Greenespan and whatever the liar in charge of the Fed is called. Still too many logical fallacies and misrepresentations using often false information. I would give this more than 2 thumbs down if I could.

... View More