This is How Movies Should Be Made

... View MoreTrue to its essence, the characters remain on the same line and manage to entertain the viewer, each highlighting their own distinctive qualities or touches.

... View MoreGreat movie. Not sure what people expected but I found it highly entertaining.

... View MoreWorth seeing just to witness how winsome it is.

... View MoreI don't know anything about economics but I found this program very interesting and definitely entertaining! At times if I stopped paying attention I got slightly lost, but it explained things in multiple ways to make it easier to understand. The funny clips from movies and cartoons were great and well-placed to highlight what was being talked about.

... View MoreThis was a pretty good retelling of the financial crisis and told it in an interesting way, which is sure to please regular folks who aren't all that into these matters.The illustrations were good, overall very nice production value.Bubbles are mentioned - by a dedicated song even (!). However, it is glaringly obvious that no views on the current bubble(s) we're in were allowed to be included in the final cut of the film.It would have been a lot better if they had gone into more detail on how the current state of the economy is far worse than the last financial crisis and what people can do to protect themselves.

... View MoreOK, so maybe you have to be an economist (like me) or a financial analyst to enjoy this 70 minute trip through the periodic financial crises (like the one in 2008) that seem to plague capitalism, but I believe any educated person interested in the causes and after-effects of the 2008 crisis can enjoy this film. It's an interesting combination of animation, puppetry, and original songs that's melded with serious commentary by a number of well-known and influential economists including three Nobel Prize winners. We learn about the various "asset price bubbles" that preceded the unsustainable run-up in home prices prior to the financial crisis and stock market crash of 2008, like the tulip bubble in 17th century Holland, the South Seas bubble in 18th century Britain, and of course the Wall Street crash of 1929. Terry Jones, one of the filmmakers, proves once again that the Monty Python comedy troupe harbored some of the most intelligent, if zany, comedians you'll find anywhere.The larger issue in this unusual and amusing documentary is the inability of the prevailing mainstream paradigm in economics (the "neo-classical synthesis" for you aficionados) to reflect the mass psychology of financial markets and institutions and their periodic proclivity to either "irrational exuberance" or morbid fear. In addition, the regulatory authorities periodically accommodate market excesses by deregulation and then become more restrictive when the financial excesses have already wrecked the real economy as shown in this film. I am largely sympathetic with this point of view and have long felt that economics suffers from "physics envy" with its elaborate mathematical models (made possible by the assumption that economic agents are optimizing and calculating machines) and its emphasis on market equilibriums. Some of the speakers in this film suggest that economics would be more realistic if it became more of a narrative and descriptive discipline similar to the other social sciences and made less heroic assumptions about the rationality of its agents. Of course, that would be at the expense of the "rigor" of the discipline. Unfortunately, there were no counter-arguments presented by the filmmakers, and at the end we have one economist say: "we have to re-design a new economy." When I hear that, I'm left with the thought that just maybe the periodic excesses in financial markets are the necessary price we must pay for the dynamism of a market economy.

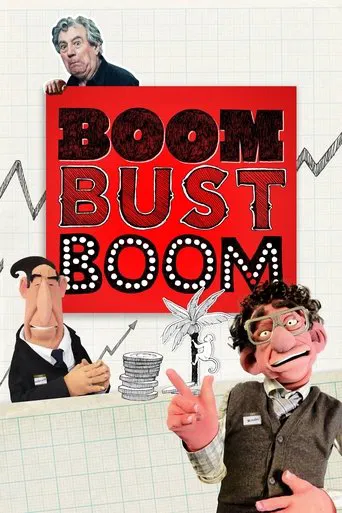

... View MoreGreetings again from the darkness. On the heels of Adam McKay's scathing and entertaining explanation of the 2008 financial collapse comes Terry Jones (of Monty Python fame) with a more global perspective of the same era. McKay's Oscar nominated The Big Short was designed to let us know who did what and why, while Jones' version applies a British spin and his wildly creative approach in breaking down the long-standing economic models that wreak havoc with our money.Jones has joined forces with Economics Professor Theo Kocken to school us on the "leftover" strategies and economic models used by Politicians and Bankers models that assume the market (investors and institutions) will act rationally. Our education comes courtesy of a multi-media show featuring animation, puppets, music and expert interviews (economists, authors, academic leaders, and at least 3 Nobel Prize winners). According to the movie (and it's difficult to argue otherwise), human nature is the Achilles heel of Capitalism. In fact, they use the term euphoria to describe the phenomenon that occurs as "stable" economic times lead to more risk and more debt. Debt clearly is the most profound 4-letter word in economics. A film within the film "Terry Jones' Short History of Financial Crisis" takes us back to the 1500's and through modern times, as the same mistakes recur. One of the more effective sequences shows State of the Union addresses from President Calvin Coolidge (1928) and President George W Bush (2006). Both speeches proclaim solid economies only 1-2 years prior to the two biggest collapses in U.S. history just two extreme examples that the experts have no idea where the economy is headed as long as they continue to utilize the models that have proved to be ineffective.It's fascinating to get specifics on Hyman Minsky's "Financial Instability Hypothesis", as well as an explanation of the Neoclassical Economic Model (better known as the Free Market). Insight is provided by University of Texas Professor James Galbraith, son of famed economist John K Galbraith, and it's quite enlightening to hear Allan Greenspan (a long time believer in the Free Market system) admit to being wrong about expecting rational behavior from those in the market.The movie will forever act as a reminder for us to pinch ourselves should we think "this time is different". In fact there is a movement by Economics students to change the way Economics degrees and PhD programs are structured – more emphasis on learning from history, and re-thinking and re-designing economic models. The applicable websites are: http://www.rethinkeconomics.org/ http://www.ecnmy.org/

... View More